Stock Diversification • Investment News Hot List • AIRE Celebrates 5 Years

Monthly AIRE Perspectives – November 2025

Dear Friends and Valued Clients,

Please see below for The MAP – Monthly AIRE Perspectives for this month.

On Proper Stock Diversification

We frequently speak about the dangers of “following the herd” and the tendency for investors to “buy high” by considering stocks that are in the news, which often leads to underperformance in the long run. Over the past 10 years, large cap stocks have had a historically outsized run, outperforming small caps as well as their own historical averages. This outperformance has been led by a handful of the largest and most successful companies. Our recommendation, however, is to stay diversified within equities, and to on large-, mid- and small-caps, as well as international stocks. Here is an excellent piece from Dimensional on the topic:

ABOVE THE FRAY – Small Caps Have Done Better Than You Think

Wes Crill, PhD, Senior Client Solutions Director and Vice President

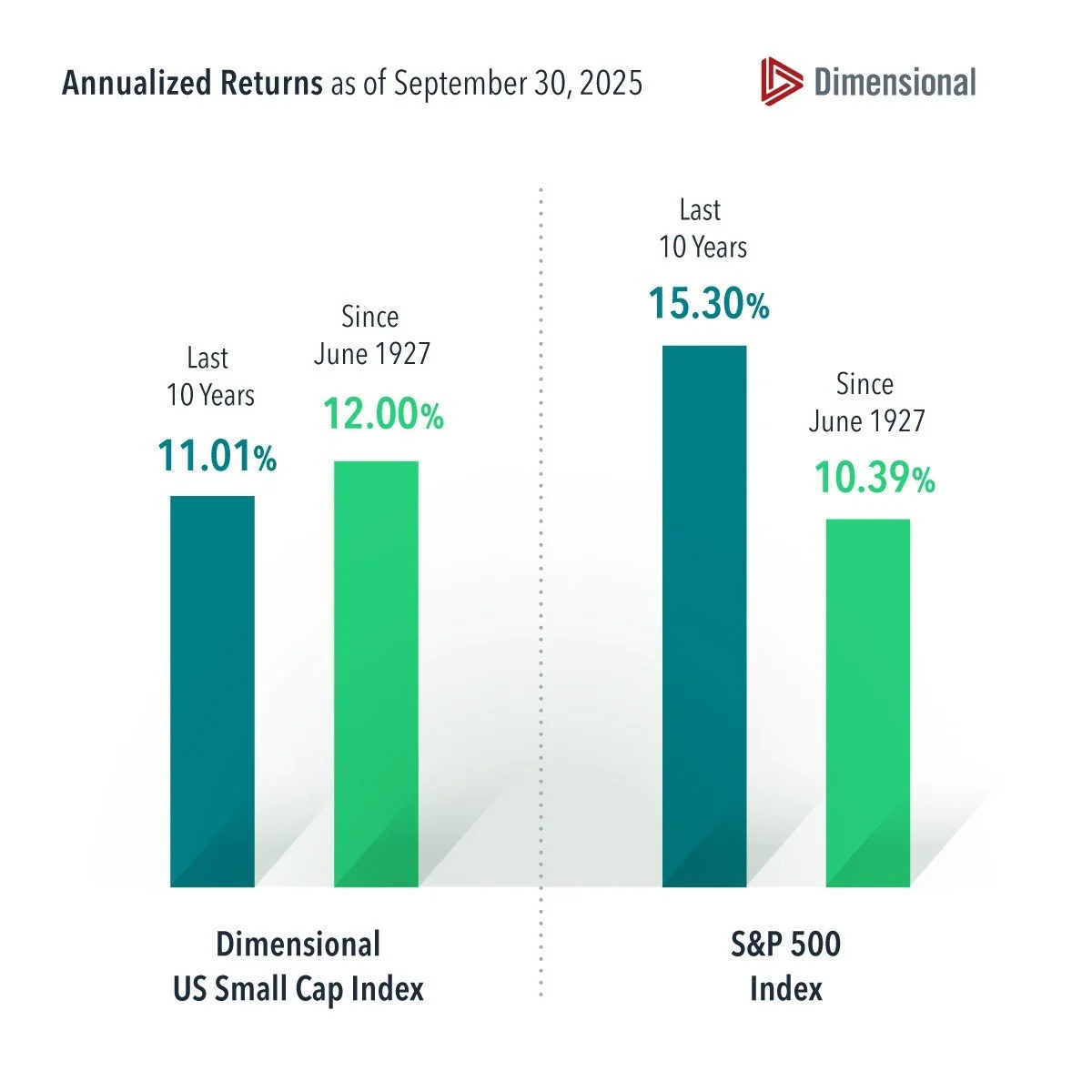

One of the most common questions I hear is, “What’s wrong with small caps?” This concern usually stems from relative returns over the past 10 years, during which US small caps underperformed the S&P 500 Index by a little over four percentage points. But which one of these asset classes has been behaving abnormally?

US small cap’s return over the last decade was within one percentage point of its average since 1927, at 11.01% vs. 12.00%. The large cap S&P 500, on the other hand, was far from its long-run average. The index returned more than 15% over the last 10 years, nearly 50% more than its average since 1927 of 10.39%.

The S&P 500 has substantial weight in companies like the Magnificent 7 that have exceeded investor expectations with their earnings growth in recent years.1 When investors are surprised in a good way, outsize returns may follow. That’s a windfall for investors with diversified portfolios. But expecting a continuation of large cap returns well in excess of the historical norm is betting on further unexpected success stories for these firms.

Many people have been searching for stories to explain US small cap underperformance. We’ve written previously about looking at the bigger picture with small cap returns and how some of the concerns over the current opportunity set may be overblown. But the stark contrast between short-term and long-term large cap returns suggests maybe investors are questioning the wrong segment of the market.

Past performance is not a guarantee of future results. Actual returns may be lower. In USD. S&P data © 2025 S&P Dow Jones Indices LLC, a division of S&P Global. All rights reserved. The Dimensional US Small Cap Index represents academic concepts that may be used in portfolio construction and is not available for direct investment or for use as a benchmark. Index returns are not representative of actual portfolios and do not reflect costs and fees associated with an actual investment. See “Index Descriptions” for descriptions of the Dimensional index data. Indices are not available for direct investment; therefore, their performance does not reflect the expenses associated with the management of an actual portfolio.

New and Improved AIRE Client Portal and App

As a reminder, we have revamped our Client Portal and AIRE Advisors app to improve your experience. Within the Client Portal and app, you can view your transactions, account performance, holding details, documents, and much more! Earlier this month, all clients received two separate emails from our team – one for the portal and one for the app. If you had any difficulty signing up, please contact our office and we will help you get signed on.

Investment News Hot List 2025

We mentioned in last month’s MAP that AIRE CEO Amir Monsefi was named to the Investment News Hot List of Top Financial Professionals in the US for 2025. The article was published in their newest issue on November 11th, and you can read the article by clicking here.

AIRE Advisors Thought Leadership on Panel at Markets Group Advisor Conference

Amir recently served on a panel at the Markets Group Advisor Conference in Beverly Hills, speaking to a group of established advisors in the Los Angeles area. The topics of discussion were practice management, the use of AI, and best practices in advisory.

AIRE ADVISORS CELEBRATES 5 YEARS!

AIRE Advisors began its journey on November 20, 2020. This Thursday, we celebrate our 5-year anniversary! In the past 5 years, our assets under management have grown three-fold to almost $1 billion, but more importantly, our processes and delivery of services have expanded and improved each year.

When people ask us what our goals are for the future, our answer is never about a number, such as revenue or assets under management. We feel that those results should be a by-product and not a goal. Our goal is simple – and one that we will never achieve: to be perfect. We strive each day to become the absolute best at what we deliver to clients, and we are incessantly working to improve. We strive to always stay ahead of industry advancements and we know that our company will look very different 5 years from now. We already have many specific plans in place for the expansion of our services, and our commitment to you is that we will be better each year.

We would like to take this opportunity to thank you for entrusting us with your families’ financial futures. It is a responsibility we do not take lightly, and we are truly humbled by your trust and loyalty. We look forward to many more great years ahead!

Once again, we would like to thank you for your trust and loyalty, and look forward to speaking with you in the upcoming month.

The commentary and opinions expressed in our articles on this page reflects the personal opinions, viewpoints and analyses of the AIRE Advisors, LLC employees writing the article. The articles on our website should not be regarded as a description of advisory services provided by our firm or performance returns of any AIRE Advisors, LLC’s clients. Any past performance discussed in these articles is no guarantee of future results. The views reflected in the articles are general in nature and made to provide education about the financial industry. These views and opinions are subject to change without notice. Any mention of a particular security, sector, and related performance data is not a recommendation to buy or sell that security or in that sector. Our firm manages client accounts using a variety of investment techniques and strategies, which are not necessarily discussed in the articles. To determine what kind of investments may be appropriate for you, please consult your financial advisor prior to investing. Also, please note that all investing involves risk and the possible loss of principal capital.

In addition, AIRE Advisors, LLC may provide links hyperlinks for your convenience to websites produced by other providers of industry related material. Accessing websites through links directs you away from our website. Our firm is not responsible for errors or omissions in the material on third party websites and does not necessarily approve of or endorse the information provided. Users who gain access to third party websites may be subject to the copyright and other restrictions on use imposed by those providers and assume responsibility and risk from use of those websites.